Expanding Investment Horizons with Huxley Capital

It’s often said that the best ideas come from casual water cooler conversations with colleagues. Huxley Capital was born from just such a passing conversation between Paul Scanlon and Matthew Callahan.

The thought leaders behind Huxley Capital identified a gap in opportunities for School of Business students seeking to hone their asset allocation skills. Thus, Huxley was created as a multi-asset investment vehicle, focusing on asset allocation across equity and fixed income markets.

“Huxley was developed to expand experiential finance opportunities in asset allocation and broader portfolio management,” Scanlon reflected. “We wanted to bolster students’ capabilities beyond equity analysis and stock picking, where we already have a robust set of opportunities.”

As spring 2024 reached its peak, Huxley was built from the ground up. Over 35 rising sophomores and juniors from the School of Business applied for 10 coveted seats in the inaugural Huxley Capital summer program. Interns were selected based on their academic records, faculty recommendations, and prior experience.

In late May, interns gathered at the Ryan Center’s Financial Resources Lab to embark on their 10-week internship. They were greeted by a team of experienced advisors. Led by Paul Scanlon, director of the Providence College finance lab and a long-time industry leader, the interns were in capable hands. Additional advising and mentorship came from Matthew Callahan, assistant professor of practice; Curt Morley, a recently retired Wall Street veteran with over 30 years of experience; and Ed Szado, associate professor of finance and department chair. Guest advisors included Arati Kale, Sylvia Maxfield, and Kevin McMahon.

Nate Faria ’26 shared, “The best part of the internship was speaking with the advisors, who gave us invaluable advice about working in the field, navigating the internship process, and making a good impression at a firm. I cannot thank them enough.” Scanlon added, “The level of investment and involvement from the advisors and guest speakers was a huge part of what we accomplished this summer with Huxley.”

Among Huxley Capital’s leadership, five clear goals for the program were established:

- Increase market fluency.

- Cultivate in interns a specialized knowledge of a sub-asset class.

- Have interns become conversant on concepts of risk and portfolio construction.

- Generate positive returns on the dedicated portfolio.

- Attain a minimum of four subject-area certifications through Wall Street Prep.

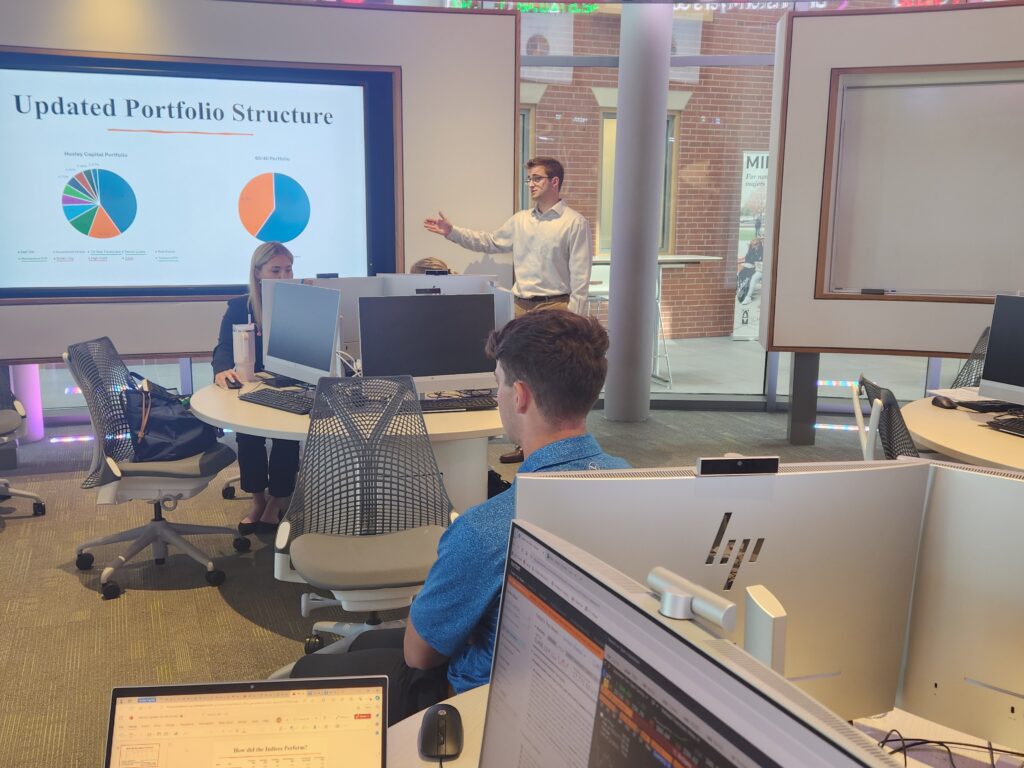

Throughout the summer, the intern team was given seed funding to develop a portfolio designed to outperform their benchmark—a 60/40 portfolio. The interns were divided into three teams: the macro team, the equities team, and the fixed income team. Each team led discussions on market influences and was responsible for making portfolio recommendations.

In addition to their portfolio management roles, the interns hosted an impressive roster of guest speakers from the industry. These speakers shared expertise in areas such as fixed income strategy, cryptocurrency, venture capital and private equity, large and small firm wealth management, and hedge fund investing.

Despite the busy schedule, interns leaned into platforms like Bloomberg, Wall Street Prep, and FactSet to enhance their knowledge and drive portfolio decision-making—critical tools used by professionals in the field.

The highlight of each week was a market update, held virtually. Each team presented thoughtful, fact-driven analyses of their respective markets as they related to the portfolio. These sessions, attended by School of Business administrators, faculty, students, advisors, speakers, and friends, allowed the interns to refine both their market fluency and their public speaking skills.

While all the stated goals were achieved, most impressively, Huxley Capital outperformed their 60/40 benchmark. “When we began the summer, we were concerned that the market might be quiet, but it turned out to be quite volatile. The team did a great job building a portfolio that outperformed its benchmark and made money for PC,” Scanlon remarked.

Reflecting on the summer’s unexpected outcomes, Scanlon said, “One of the surprise positives was the great group of guest speakers, as well as watching the interns develop strong communication and presentation skills as they discussed sophisticated concepts in a very volatile market.”

Laci Deftos ’26 reflected on her experience: “I feel incredibly fortunate to have been part of such a remarkable program. I am deeply grateful for the opportunity to participate as an intern.” Though the summer was demanding, it proved to be an invaluable experience. “There were moments when I found the work challenging, but I embraced those challenges and ended up learning more than I ever imagined I would.”

Huxley Capital Interns

- Natasha Biah ’26, Macro Team

- James Browning ’26, Macro Team

- Laci Deftos ’26, Equities Team

- Nathan Faria ’26, Macro Team

- Mia Hoffman ’26, Fixed Income Team

- Ty Longo ’26, Fixed Income Team

- Rhett Newton ’26, Equities Team

- Arianna Robinson ’26, Fixed Income Team

- Colin Treacy ’26, Equities Team

- Ryan Varley ’26, Fixed Income Team